Inflation Causes Pain for Strata Owners in More Ways Than One

By Teighan Carr

Today (3 February 2025) the Reserve Bank of Australia announced an interest rate increase of 0.25 basis points taking the official cash rate to 3.85 (https://www.rba.gov.au/media-releases/2026). Much of the focus will understandably be on borrowing costs for home owners and cash flow pressures. For owners with an average annual mortgage $600,000 this means an approximate increase to the repayment by $90 per month. For the strata industry, interest rate movements have broader implications that extend beyond lending.

Strata Managers continually need to set budgets for buildings on today’s costs and future expenses. The immediate cost of inflation is quickly seen in annual renewals of insurance, energy costs, strata manager fees and building maintenance costs such as lawns and cleaning. However future costs are also budgeted for upgrades that will continue to be incurred into the future such as repainting, upgrading lifts, re-roofing and electronic machinery breakdown (air conditioning/heating, doors and garages).

Why is inflation an important topic?

Inflation erodes purchasing power. The same dollar buys less over time, so the real value of goods (building material, labour), money and savings falls in value as inflation is sustained at high levels.

Understanding how interest rates, inflation and insurance pricing intersect is becoming increasingly important in the current economic environment.

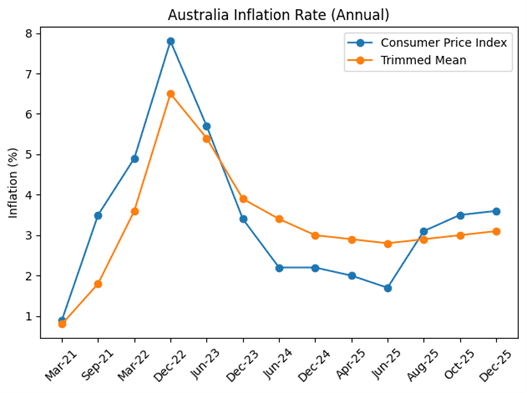

Australia’s inflation figures have been running rampant since March 2021 and 13 consecutive rate increases since May 2022 to Feb 2025 were only able to deter inflation temporarily. Inflation is an ongoing problem for all Australians that have a mortgage and are borrowing funds for building repairs and maintenance. This also means that owners will be looking to recoup increasing costs from renters and this will ultimately lead to a whole lot of other problems!

Graph shows annual movement. Source: Australian Bureau of statistics, Consumer price Index Jan 7 2026.

Inflation and the Rising Cost of Claims

Interest rate changes are the only tool at the RBA’s disposal when managing inflation. Elevated inflation levels since cutting rates temporarily in 2025 means strata owners may also see an ongoing impact to the cost of construction materials and labour across Australia.

From an insurance perspective, inflation directly affects the cost of insurance claims. Rebuilding or repairing a property following a loss today is significantly more expensive than it was even a few years ago. Increased material costs, labour shortages, longer build times and higher professional fees all contribute to higher claim settlements for insurers.

As these costs rise, insurers must factor the increased cost of claims into their pricing models, which can place upward pressure on premiums across commercial and strata portfolios.

The Importance of Up-to-Date Valuations

One of the most significant risks in an inflationary environment is underinsurance.

Construction cost inflation can quickly render previously acceptable building valuations outdated and leave owners exposed to not having funds to replace or rebuild a property following a loss. A valuation completed several years ago may no longer reflect the true cost to rebuild a property to current standards, codes and regulations.

For property owners and body corporates, this creates a dual risk:

In the event of a major loss, the sum insured may be insufficient to fully rebuild the property; and

From an insurer’s perspective, underinsurance can distort risk assessment and claims outcomes.

Regular, independent and up-to-date insurance valuations are therefore critical. Ensuring that declared sums insured accurately reflect current rebuild costs helps protect against underinsurance and supports more effective risk placement with insurers.

Inflation and government spending can impact Insurance Premiums

Insurance premiums in strata are largely driven by the value of a property for replacement, the quality of the building, catastrophic external exposures and the legacy claims for the building that provide an indication for future losses.

Inflation impacts both the building sum insured for replacement and the ongoing increase in the costs of building materials and labour for claims repairers.

If inflation is not controlled by RBA rate increases and responsible government spending, insurers may seek to manage this increased exposure through a combination of:

Premium increases

Adjustments to policy terms or excesses for more complex placements

Greater scrutiny of declared values and risk information

While premium increases are never welcome, they also reflect the economic situation we are in. Insurance premium increases are not just viewed through the lens of bushfires and storms but also through the underlying cost of inflation to repairing or rebuilding a property in today’s market.

At Sage it is our belief that today's announcement of the interest rate increase will put upwards pressure on owners and their mortgages and insurance premiums. However the issues mentioned in this article will continue for some time if inflation continues to above 3% and if government decisions don’t work to reduce inflation.

There are many causes of inflation and whilst most of those are known, there will always be unforeseen events that can have an impact. We urge all unit owners and Strata Managers to continue to be vigilant and encourage robust budgeting throughout 2026 to help create the best outcomes for all owners and occupiers.

Teighan Carr has over 13 years of experience and deep expertise across the Strata and Real Estate sector, leading with a strong focus on innovation, collaboration and tailored insurance solutions.

Today (3 February 2025) the Reserve Bank of Australia announced an interest rate increase of 0.25 basis points taking the official cash rate to 3.85 (https://www.rba.gov.au/media-releases/2026). Much of the focus will understandably be on borrowing costs for home owners and cash flow pressures. For owners with an average annual mortgage $600,000 this means an approximate increase to the repayment by $90 per month. For the strata industry, interest rate movements have broader implications that extend beyond lending.

Strata Managers continually need to set budgets for buildings on today’s costs and future expenses. The immediate cost of inflation is quickly seen in annual renewals of insurance, energy costs, strata manager fees and building maintenance costs such as lawns and cleaning. However future costs are also budgeted for upgrades that will continue to be incurred into the future such as repainting, upgrading lifts, re-roofing and electronic machinery breakdown (air conditioning/heating, doors and garages).

Why is inflation an important topic?

Inflation erodes purchasing power. The same dollar buys less over time, so the real value of goods (building material, labour), money and savings falls in value as inflation is sustained at high levels.

Understanding how interest rates, inflation and insurance pricing intersect is becoming increasingly important in the current economic environment.

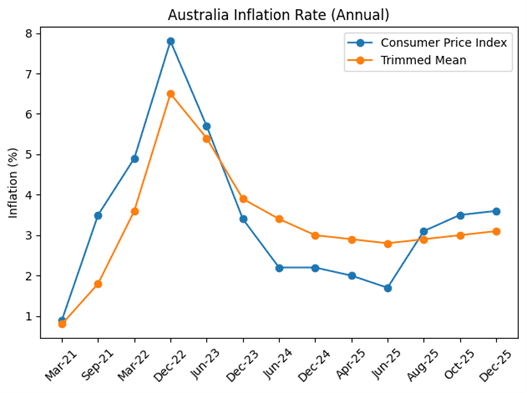

Australia’s inflation figures have been running rampant since March 2021 and 13 consecutive rate increases since May 2022 to Feb 2025 were only able to deter inflation temporarily. Inflation is an ongoing problem for all Australians that have a mortgage and are borrowing funds for building repairs and maintenance. This also means that owners will be looking to recoup increasing costs from renters and this will ultimately lead to a whole lot of other problems!

Graph shows annual movement. Source: Australian Bureau of statistics, Consumer price Index Jan 7 2026.

Inflation and the Rising Cost of Claims

Interest rate changes are the only tool at the RBA’s disposal when managing inflation. Elevated inflation levels since cutting rates temporarily in 2025 means strata owners may also see an ongoing impact to the cost of construction materials and labour across Australia.

From an insurance perspective, inflation directly affects the cost of insurance claims. Rebuilding or repairing a property following a loss today is significantly more expensive than it was even a few years ago. Increased material costs, labour shortages, longer build times and higher professional fees all contribute to higher claim settlements for insurers.

As these costs rise, insurers must factor the increased cost of claims into their pricing models, which can place upward pressure on premiums across commercial and strata portfolios.

The Importance of Up-to-Date Valuations

One of the most significant risks in an inflationary environment is underinsurance.

Construction cost inflation can quickly render previously acceptable building valuations outdated and leave owners exposed to not having funds to replace or rebuild a property following a loss. A valuation completed several years ago may no longer reflect the true cost to rebuild a property to current standards, codes and regulations.

For property owners and body corporates, this creates a dual risk:

In the event of a major loss, the sum insured may be insufficient to fully rebuild the property; and

From an insurer’s perspective, underinsurance can distort risk assessment and claims outcomes.

Regular, independent and up-to-date insurance valuations are therefore critical. Ensuring that declared sums insured accurately reflect current rebuild costs helps protect against underinsurance and supports more effective risk placement with insurers.

Inflation and government spending can impact Insurance Premiums

Insurance premiums in strata are largely driven by the value of a property for replacement, the quality of the building, catastrophic external exposures and the legacy claims for the building that provide an indication for future losses.

Inflation impacts both the building sum insured for replacement and the ongoing increase in the costs of building materials and labour for claims repairers.

If inflation is not controlled by RBA rate increases and responsible government spending, insurers may seek to manage this increased exposure through a combination of:

Premium increases

Adjustments to policy terms or excesses for more complex placements

Greater scrutiny of declared values and risk information

While premium increases are never welcome, they also reflect the economic situation we are in. Insurance premium increases are not just viewed through the lens of bushfires and storms but also through the underlying cost of inflation to repairing or rebuilding a property in today’s market.

At Sage it is our belief that today's announcement of the interest rate increase will put upwards pressure on owners and their mortgages and insurance premiums. However the issues mentioned in this article will continue for some time if inflation continues to above 3% and if government decisions don’t work to reduce inflation.

There are many causes of inflation and whilst most of those are known, there will always be unforeseen events that can have an impact. We urge all unit owners and Strata Managers to continue to be vigilant and encourage robust budgeting throughout 2026 to help create the best outcomes for all owners and occupiers.

Teighan Carr has over 13 years of experience and deep expertise across the Strata and Real Estate sector, leading with a strong focus on innovation, collaboration and tailored insurance solutions.

Today (3 February 2025) the Reserve Bank of Australia announced an interest rate increase of 0.25 basis points taking the official cash rate to 3.85 (https://www.rba.gov.au/media-releases/2026). Much of the focus will understandably be on borrowing costs for home owners and cash flow pressures. For owners with an average annual mortgage $600,000 this means an approximate increase to the repayment by $90 per month. For the strata industry, interest rate movements have broader implications that extend beyond lending.

Strata Managers continually need to set budgets for buildings on today’s costs and future expenses. The immediate cost of inflation is quickly seen in annual renewals of insurance, energy costs, strata manager fees and building maintenance costs such as lawns and cleaning. However future costs are also budgeted for upgrades that will continue to be incurred into the future such as repainting, upgrading lifts, re-roofing and electronic machinery breakdown (air conditioning/heating, doors and garages).

Why is inflation an important topic?

Inflation erodes purchasing power. The same dollar buys less over time, so the real value of goods (building material, labour), money and savings falls in value as inflation is sustained at high levels.

Understanding how interest rates, inflation and insurance pricing intersect is becoming increasingly important in the current economic environment.

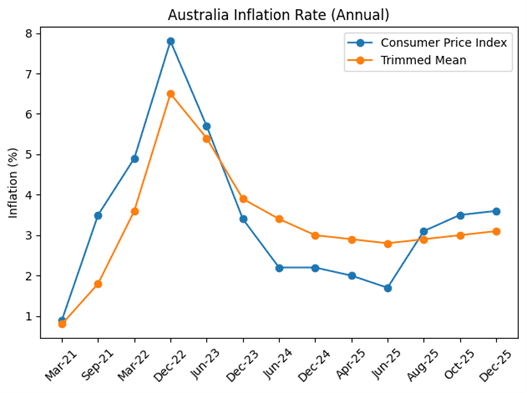

Australia’s inflation figures have been running rampant since March 2021 and 13 consecutive rate increases since May 2022 to Feb 2025 were only able to deter inflation temporarily. Inflation is an ongoing problem for all Australians that have a mortgage and are borrowing funds for building repairs and maintenance. This also means that owners will be looking to recoup increasing costs from renters and this will ultimately lead to a whole lot of other problems!

Graph shows annual movement. Source: Australian Bureau of statistics, Consumer price Index Jan 7 2026.

Inflation and the Rising Cost of Claims

Interest rate changes are the only tool at the RBA’s disposal when managing inflation. Elevated inflation levels since cutting rates temporarily in 2025 means strata owners may also see an ongoing impact to the cost of construction materials and labour across Australia.

From an insurance perspective, inflation directly affects the cost of insurance claims. Rebuilding or repairing a property following a loss today is significantly more expensive than it was even a few years ago. Increased material costs, labour shortages, longer build times and higher professional fees all contribute to higher claim settlements for insurers.

As these costs rise, insurers must factor the increased cost of claims into their pricing models, which can place upward pressure on premiums across commercial and strata portfolios.

The Importance of Up-to-Date Valuations

One of the most significant risks in an inflationary environment is underinsurance.

Construction cost inflation can quickly render previously acceptable building valuations outdated and leave owners exposed to not having funds to replace or rebuild a property following a loss. A valuation completed several years ago may no longer reflect the true cost to rebuild a property to current standards, codes and regulations.

For property owners and body corporates, this creates a dual risk:

In the event of a major loss, the sum insured may be insufficient to fully rebuild the property; and

From an insurer’s perspective, underinsurance can distort risk assessment and claims outcomes.

Regular, independent and up-to-date insurance valuations are therefore critical. Ensuring that declared sums insured accurately reflect current rebuild costs helps protect against underinsurance and supports more effective risk placement with insurers.

Inflation and government spending can impact Insurance Premiums

Insurance premiums in strata are largely driven by the value of a property for replacement, the quality of the building, catastrophic external exposures and the legacy claims for the building that provide an indication for future losses.

Inflation impacts both the building sum insured for replacement and the ongoing increase in the costs of building materials and labour for claims repairers.

If inflation is not controlled by RBA rate increases and responsible government spending, insurers may seek to manage this increased exposure through a combination of:

Premium increases

Adjustments to policy terms or excesses for more complex placements

Greater scrutiny of declared values and risk information

While premium increases are never welcome, they also reflect the economic situation we are in. Insurance premium increases are not just viewed through the lens of bushfires and storms but also through the underlying cost of inflation to repairing or rebuilding a property in today’s market.

At Sage it is our belief that today's announcement of the interest rate increase will put upwards pressure on owners and their mortgages and insurance premiums. However the issues mentioned in this article will continue for some time if inflation continues to above 3% and if government decisions don’t work to reduce inflation.

There are many causes of inflation and whilst most of those are known, there will always be unforeseen events that can have an impact. We urge all unit owners and Strata Managers to continue to be vigilant and encourage robust budgeting throughout 2026 to help create the best outcomes for all owners and occupiers.

Teighan Carr has over 13 years of experience and deep expertise across the Strata and Real Estate sector, leading with a strong focus on innovation, collaboration and tailored insurance solutions.